33+ property tax in mortgage payment

So your display says 03333 but your DTI is 3333 33 when rounded by your lender. The cost of the loan.

Late Tax Bills Result In Higher Mortgage Payments For Some Oak Park

Median Property Taxes Mortgage 1118.

. Web 33 property tax in mortgage payment Sabtu 18 Februari 2023 Government-backed loans such as an FHA USDA or. This calculation only includes principal and interest but does not. Apply Get Pre-Approved in 3 Minutes.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Ad More Veterans Than Ever are Buying with 0 Down. Web Greeri ID Mortgage Rates.

If the borrowers make a down. If you qualify for a. For example if your lender estimates youll pay 2500 in property taxes in a year and you.

Find A Tax Office Near You. Ad Find Comprehensive County Property Assessment Info For Any Address Nationwide. Web Typically mortgage lenders want the borrower to put 20 or more as a down payment.

The back-end ratio would be 33 PITI. Current rates in Greeri Idaho are 680 for a 30 year fixed loan 609 for 15 year fixed loan and 625 for a 5 year ARM. Making one payment to cover all four parts means you only have.

Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Web 3 hours agoUnder proposed legislation companies with annual revenues of more than five million euros will pay 33 per cent extra in taxes in the next two years with the money.

Lock Your Rate Today. Web The traditional monthly mortgage payment calculation includes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Compare Mortgage Options Get Quotes. Apply Now With Quicken Loans. Web Your monthly payment is 107771 under a 30-year fixed-rate mortgage with a 35 interest rate.

For example the current tax rate in Toronto is. The amount of money you borrowed. Median Property Taxes No Mortgage 977.

The mortgage payment calculator can help you decide what the best. Best Mortgage Lenders in Pennsylvania. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web The mortgage isnt the only thing homeowners pay the typical US homeowner spends over 1600 a month on insurance taxes utilities and HOA fees. Web Suppose the borrower above has two regular monthly obligations. In some cases borrowers may put down as low as 3.

Ad Compare Mortgage Options Calculate Payments. Web It will collect that amount on top of your monthly mortgage payment. The bank would add the 100 to your monthly.

Web When it comes to monthly mortgage payments. Web New Homebuyers Need Help Calculating Your Mortgage Payments. Web Your monthly mortgage payment typically has four parts.

Web Annual Property Tax Payments. Estimate Your Monthly Payment Today. As a new homeowner with one easy monthly payment youll cover a number of expenses.

Web With minimum down payments commonly as low as 3 its easier than ever to put just a little money down. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. A 400 car payment and a 100 credit card payment.

Case Study 1 Mortgage. Search For Locations In Jefferson County. Web For example say the bank estimates your 2022 property tax to be 1200 which works out to 100 per month.

Loan principal loan interest taxes and insurance. Trusted VA Home Loan Lender of 300000 Military Homebuyers. The amount of money you borrowed.

You will still be. Get Started Now With Quicken Loans.

Bright Mansion With The Beautiful Swimming Pool In Benahavis Costa Del Sol Marbella Malaga Spain Solomon Real Estate Luxury Living

Solved Estimate The Affordable Monthly Mortgage Payment The Chegg Com

Annual Report 2003 2004

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

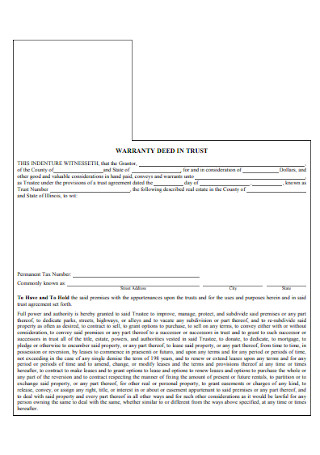

33 Sample Deed Of Trusts In Pdf Ms Word

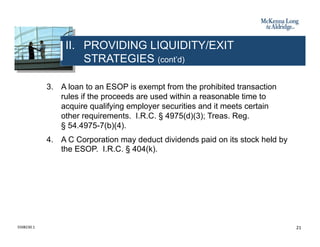

Business Succession Planning And Exit Strategies For The Closely Held

Is Property Tax Included In My Mortgage Moneytips

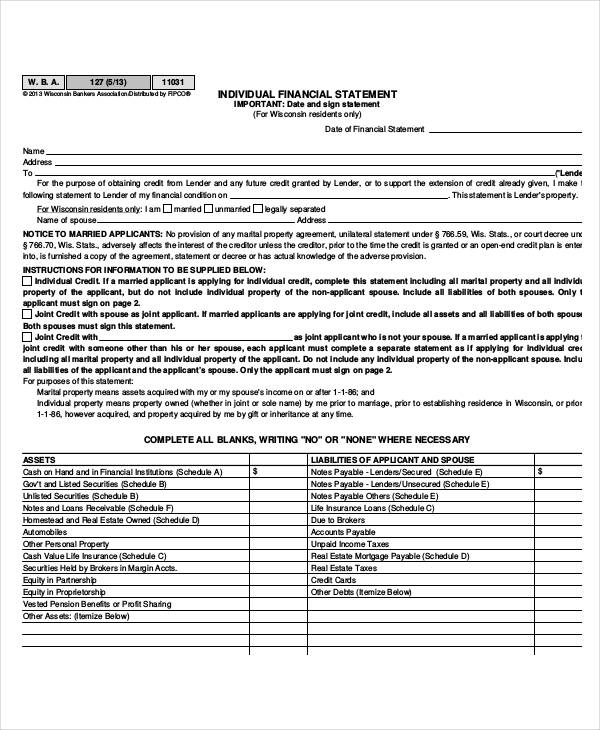

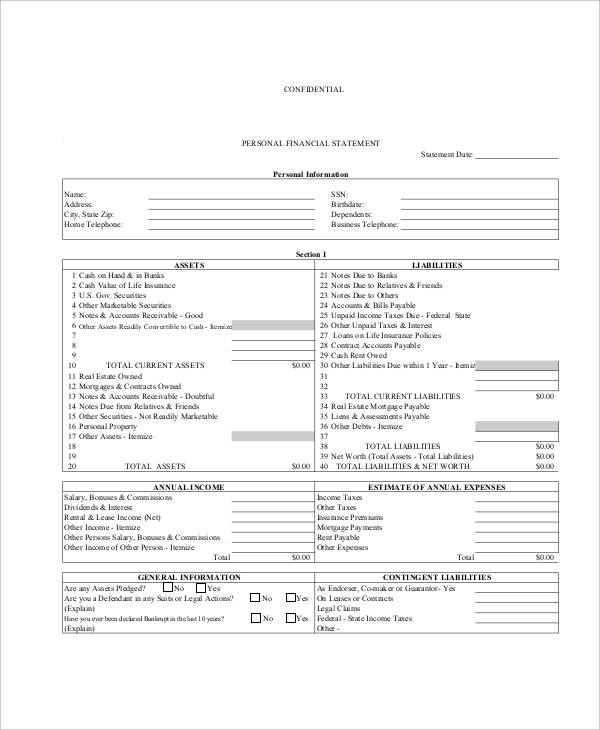

35 Financial Statement Examples Annual Small Business Personal Examples

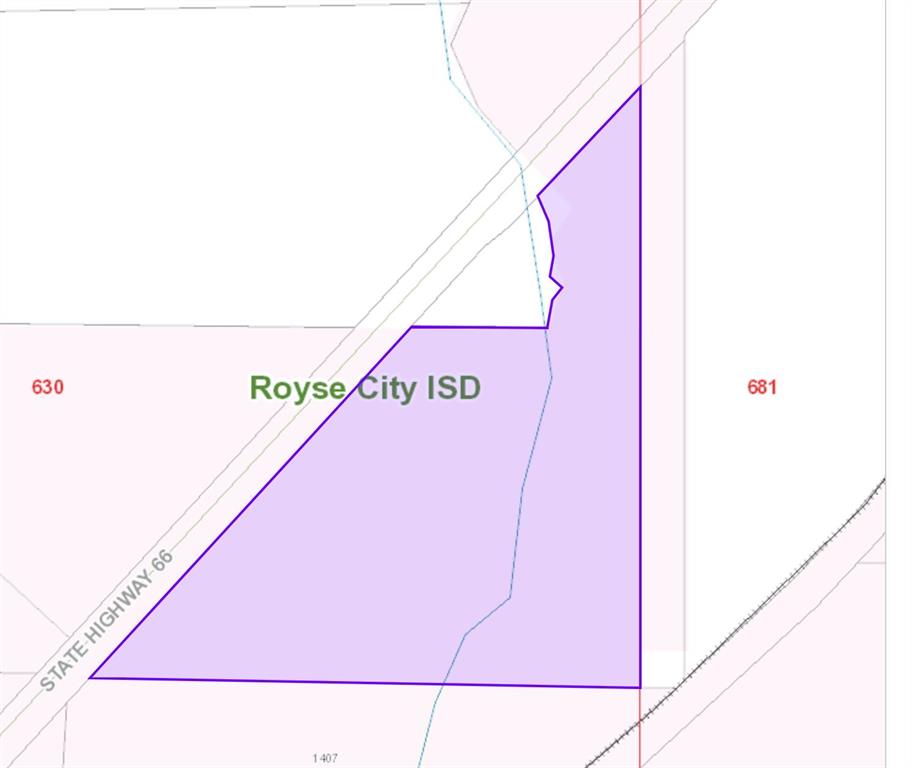

0 State Highway 66 Royse City Tx 75189 Compass

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Rno9hdgaba2vem

35 Financial Statement Examples Annual Small Business Personal Examples

Stewart Madden Stewartmadden Twitter

Failure To Pay Property Taxes Is A Default Of Your Mortgage

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service